Researching for an MBA is a

considerable expenditure, but is it well worth the expense? The economic system

is in problems, work is scarce, salaries have dipped and college students are

scrambling basically to discover summer time internships, let alone entire-time

positions. So does it make a difference, the place you study your MBA? Is

there very clear value in a Harvard or other Ivy League institution MBA Program? And

how long might it just take you to recoup the expense?

Researching for an MBA is a

considerable expenditure, but is it well worth the expense? The economic system

is in problems, work is scarce, salaries have dipped and college students are

scrambling basically to discover summer time internships, let alone entire-time

positions. So does it make a difference, the place you study your MBA? Is

there very clear value in a Harvard or other Ivy League institution MBA Program? And

how long might it just take you to recoup the expense?

The

Ideal of the Ideal Educational institutions

An MBA from Harvard or Stanford,

or from any number of the elite business colleges, has long been the aspiration

business qualification, irrespective of the quantity of funds you had to borrow

to make it come about.

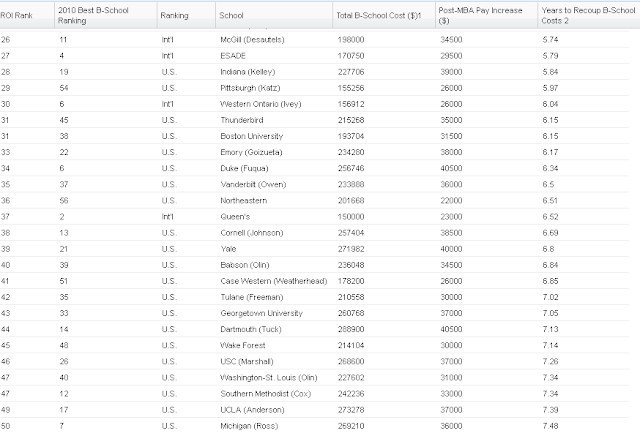

However, Bloomberg Business-week

has printed a examine which may make individuals cease and think ahead of

making this sort of expenditure in the potential. New investigation implies

that one can just take a Harvard or Stanford MBA graduate far more than 10 a

long time to entirely recoup his or her expenditure in the degree. Business-week

utilizes the pursuing requirements to evaluate the return on investment (ROI):

pre-MBA salaries, put up-MBA salaries and expense of attending business

university.

So why is the return on these

elite MBAs so sluggish? Well, one concept is that these colleges typically have

the highest tuition expenses, and they are also probably appeal to candidates

with higher pre-MBA salaries, which suggest they will not fare well in this ROI

calculation.

Which

Educational institutions are Providing the Ideal ROI?

What Business-week’s examine has

highlighted is that some colleges offer a considerably faster return on the

tuition expenditure - but they are not the kinds that are most typically

regarded as the very best. The colleges outside the most of the "Top

25" lists give college students quicker returns on their expenditure than

the acknowledged leaders in graduate business education.

Business-week’s report displays

that Texas A&M had the fast return of any U.S. based software, with the

expenditure recouped in just beneath a few and a 50 % a long time. Texas

A&M's Mays Organization Faculty, is one of the few U.S. packages that is a

calendar year and a 50 % in size, costing just beneath $70,000, so its charges

are considerably reduced than at most other colleges.

Other U.S. MBA packages at the

top of the ROI listing consist of: Michigan State's Broad College of

Organization, the College of Organization at the University of Illinois, and

Penn Point out University - which all have ROIs of beneath for a long time.

Prolonged

Awaited ROIs

The Unfortunately Chicago's Booth

Faculty was ranked previous amongst seventy one college, with a long wait

around of 14.3 a long time ahead of your original expenditure arrives to

fruition. However, relatively confusingly, as well as rating previous on ROI,

the University of Chicago's Booth Faculty of Organization concurrently ranked

initial in the "most influential of all the MBA packages in the

U.S.," which does call into issue the validity of the ROI rankings.

Is

Return on Investment decision Well worth Measuring?

So the benefits seem to be

puzzling. How can a university be previous on one listing and initial on one

more? And if Harvard is coming in at 69th out of seventy one MBA packages for

ROI, is this an expenditure well worth making?

Well, that really does relies

upon on determination. If your principal motivator is a quickly return on your

expenditure, then attending one of the 'top' educational colleges may not be

your very best wager.

The charges of these colleges are

really higher, and they appeal to candidates who currently have very higher salaries.

Texas A&M's Mays Organization Faculty graduates will make back again their

investments for more than a few times quicker than Harvard grads, which is a

placing statistic.

Should You Get an MBA?

Should You Get an MBA?Let's take a look on premier Business Schools - Harvard Business School (HBS)

>Year one- fully loaded cost

$87k/year for one person

>Year two-Repeat at

$85k/yr=>let’s round down to $170k for two year

Return

Salary is according to company/industry,

but let’s take highest median , which is private equity/LBO

>Summer internship for

LBO/private equity (assume 3 months)-$24k

>Yr three-median LBO/private

equity salary year one-$150k

>Yr four-Let’s assume 10% bump

with good performance in yr two-$165k

So , here you are , 4 yr after

first attended business school.

ROI=$339k/$170k = 1.994 or

basically 200%